| |

By

Sarah Leemann and Elie Younes - HVS International

…

How much further will it grow? Is it really a supply-led

market? Can a market correction be expected soon? What

is a reasonable marketwide stabilised performance? All

these questions have undoubtedly been discussed amongst

industry professionals who have visited Dubai or have

worked in the market over the last five years. Here

is the story and probably some answers!

Dubai,

December 2004: again one of the top outperforming

markets in the Middle East, according to HVS International's

annual survey. With RevPAR (rooms revenue per available

room) of US$124 and GOPPAR (gross operating profit per

available room) of US$110, Dubai ranked second behind

Kuwait (which was still enjoying a high ADR and extraordinary

demand due to the outbreak of and the ongoing war in

Iraq).

Dubai,

October 2005: a limited amount of new hotel

supply has entered the market since the beginning of

the year, and the market continues to see excellent

operating performances in terms of both occupancy and

average room rate. Dubai has taken the lead in the region

for the first three quarters of the year! We expect

the market to experience accelerated growth (of more

than 30%) in GOPPAR in 2005; this growth will be driven

mainly by the considerable increase in average room

rate.

Given

the historical and anticipated future supply and demand

dynamics, there is currently no consensus on the future

performance of the market; opinions are hybrid and often

controversial.

In

this article, we illustrate the historical and current

success story of Dubai, discuss and assess the market

dynamics, and provide an opinion of the potential future

performance of the market. The following topics are

addressed.

-

Overview of the UAE and Dubai;

-

Dubai tourism and initiatives;

-

Hotel market dynamics;

-

Assessment of future trends;

-

Synthesis and conclusion.

Overview

of the UAE and Dubai

Below are some of the macro economic highlights.

General Overview

-

The United Arab Emirates (UAE) consists of seven emirates:

Abu Dhabi, Ajman, Dubai, Fujairah, Ras al-Khaimah,

Sharjah and Umm al-Qaiwain. The capital and also the

richest emirate is Abu Dhabi; yet, some consider it

to be Dubai. In general, the emirates have remarkably

few tourist attractions;

-

Despite the government's substantial efforts to diversify

the economy, oil revenues remain the major economic

driver of GDP in the UAE, accounting for roughly a

third;

-

Some emirates are pursuing a policy of openness with

greater zeal than others, with Dubai remaining at

the forefront of most new initiatives. In particular,

Dubai is expected to continue to seek investors in

high technology, financial services, tourism and other

service industries to compensate for the declining

role of oil in its economy.

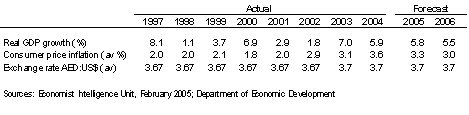

Table 1: Key Economic Indicators - UAE

-

In 2004 approximately 10% of the economic wealth was

contributed by travel and tourism. This share is expected

to rise to 10.5% in 2005;

-

According to the Economist Intelligence Unit (EIU),

the country's economy experienced strong growth of

5.9% in 2004. This growth was driven mainly by an

increase in oil output, combined with firm prices.

The country's economy is expected to continue to experience

strong growth in 2005 and 2006, with growth driven

mainly by strong oil prices.

Dubai - An Overview of the City

-

Dubai, with an area of 3,885 km², is the second-largest

emirate in the UAE. It is located in the north-eastern

part of the UAE and is currently considered to be

the only emirate that would remain prosperous without

oil and gas revenues;

-

Currently, according to the Dubai Ministry of Planning,

910,000 people (of whom almost 80% are expatriates)

live in Dubai, and they account for approximately

27% of the UAE's population;

-

Dubai has a very good infrastructure, with Dubai International

Airport being one of the busiest airports in the region,

especially in terms of transit passengers. Yet, given

the recent growth in the level of visitation and the

level of population, improvements to the road network

within the city will soon be required (infrastructural

plans and developments already exist, however, and

are underway);

-

Over the last decade, the ruling Maktoum family has

positioned Dubai as a major tourism and economic hub.

Extensive public initiatives have been undertaken

to stimulate economic growth and direct foreign investments.

Dubai Tourism and Initiatives

Visitation - Snapshot

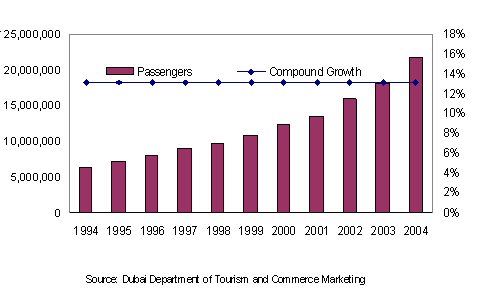

Table

2 illustrates the total number of visitor arrivals in

Dubai since 1994.

Table

2: Domestic and International Airport Passengers - Dubai,

UAE

-

Over the last 11 years, the total number of passengers

at Dubai International Airport has grown at a compound

annual rate of around 13%. Despite the war in Iraq

and recent political unrest in the Middle East, the

total number of airport passengers arriving in Dubai

increased by some 13% in 2003 and 20% in 2004, reflecting

the strong competitiveness of the emirate in the economic

and leisure sectors;

-

This upward trend was further stimulated by the increased

efforts made by the government to promote the emirate

as a politically stable destination with a booming

economy and attractive leisure facilities. In addition,

Dubai has benefited from increased intra-regional

travel following the events of 11 September 2001 and

the war in Iraq;

-

Emirates is one of the most prominent airlines at

Dubai International Airport. The company has recently

opened new routes to, for example, the USA, Australia,

the UK and China. In the last 18 months, the airline

has placed orders for 41 aircraft from Airbus and

26 from Boeing. These will come into operation progressively

over the next four years, and this will undoubtedly

have a considerable and positive impact on the level

of visitation to Dubai.

Initiatives and Developments

Some

say that one-third of all construction cranes worldwide

are currently in Dubai. Given the current level of development

in the market, such a statement is possibly not an exaggeration.

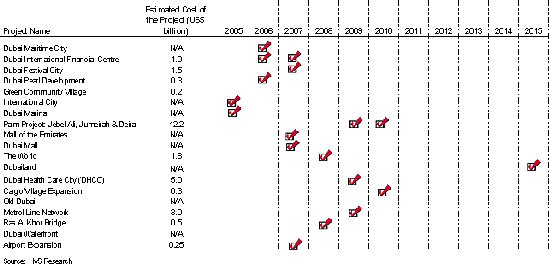

Table 3 illustrates some of the major developments currently

taking place in Dubai.

Table

3: New Projects - Dubai, UAE 2005-15

As can be seen from Table 3, there is currently an extensive

amount of new, large-scale development in Dubai that

is being developed by both the public sector and the

private sector at an estimated total cost of around

US$30 billion. Such projects relate to both leisure

and business, which is something of a reflection on

the well-balanced economic development plan for the

emirate. In addition, infrastructural projects are also

planned in Dubai, which will in all likelihood support

any growth in visitation.

Over

the last decade, Dubai has pioneered major initiatives

in the GCC region in an attempt to stimulate economic

growth and foreign direct investment. Such initiatives

and/or catalysts include the following.

-

Freehold ownership for foreigners

In May 2002 the Crown Prince of Dubai and the UAE's

Defence Minister announced that 100% freehold ownership

of certain properties in Dubai was available to all

nationalities on specific large-scale developments

(such as the Palm Islands, Dubai Land, etc) and in

certain areas of the emirate.

-

Free-Trade Zones

The government has sought to encourage global firms

to move their regional offices to Dubai by establishing

free-trade zones, such as the Jebel Ali Free Zone

(JAFZ) and, more recently, Dubai Internet City, Dubai

Media City, Dubai Knowledge Village and Dubai International

Financial Centre. Companies operating in a free-trade

zone benefit from zero duty on all imported and exported

goods and machinery within the zone, 100% foreign

ownership (no need for a local sponsor), a renewable

50-year guarantee of exemption from corporate tax,

no personal income tax and no restrictions on the

repatriation of capital and profits.

-

Obtainability of Visas

All visitors, except GCC nationals, require a visa;

however, free visit visas are issued to most nationals

entering Dubai. A visit visa is valid for up to 60

days, but can be renewed for a further 30 days upon

paying a fee of AED500 at the Department of Immigration.

Currently, nationals from more than 30 countries do

not require anymore a visa to enter the emirate/country.

Hotel Market Dynamics

Snapshot and Characteristics

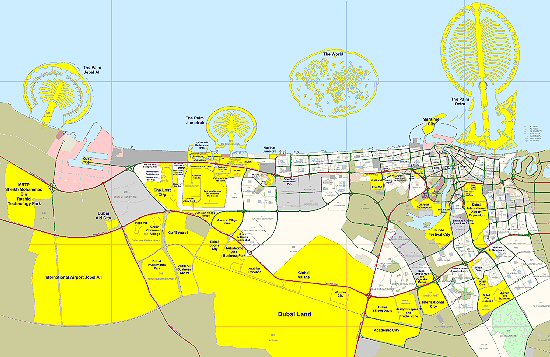

The Dubai hotel market is divided into two major sub-markets:

Jumeirah Beach and the City, as shown in the following

map. Although both markets are impacted by the same

macro-economic factors, they have different characteristics

and dynamics.

Area A: Jumeirah Beach Hotels Area B:

City Hotels

Table 4 illustrates the main characteristics of the

hotel market in Dubai. We make the following comments

on Table 4.

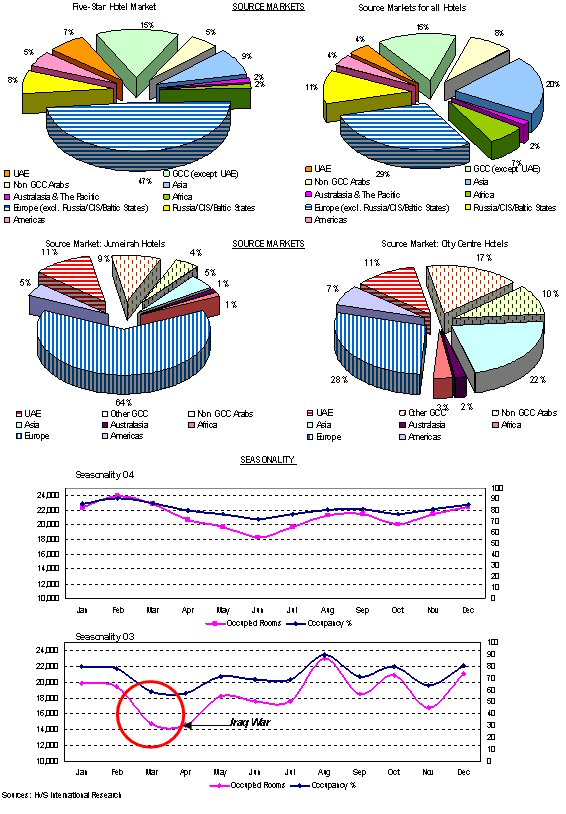

-

Europe is the main feeder market for five-star hotel

demand in Dubai, accounting as it does for around

47% of the total demand. The GCC and non-GCC Arab

countries account for some 27% of the total demand

for hotel accommodation. The market experienced increased

levels of intra-regional tourism following the events

of 11 September 2001 and the war in Iraq in 2003;

-

Published plans exist to attract the Turkish, Pakistani,

Indian, Chinese and Iranian markets over the next

three to five years;

-

The government is currently working on developing

the cruise market to Dubai,

which is also expected to have a positive impact on

international demand for hotel accommodation in the

area;

-

In general, the seasonality of demand is becoming

less volatile, thanks mainly to increased corporate

(and meeting and conference) demand throughout the

year. The peak in demand occurs in winter and spring;

this is attributable to the rise in the number of

arrivals from European nations, as the warm climate

is favourable for beach holidays, as well as increased

corporate and meeting and conference visitation.

Table

4: General Characteristics - Hotel Market, Dubai

-

The main source markets for the Jumeirah Beach hotels

are European, which account for 64% of the total demand.

Interestingly, this feeder market accounts for only

28% of the total demand in the City hotel market.

This difference is down mainly to the stimuli for

the European markets, which are different from those

of the regional and GCC markets;

-

The Arab world accounts for 38% of the total demand

for City hotels and is the main source market for

the downtown hotels.

Hotel Market Performance and Dynamics

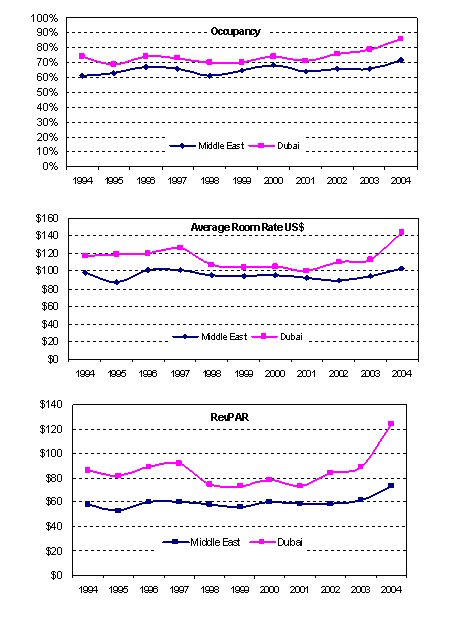

Table

5 illustrates the historical operating performance of

the hotel market in Dubai. We make the following comments

on Table 5.

-

Over the last ten years the Dubai hotel market has

outperformed the Middle East as a whole in terms of

occupancy, average room rate and, hence, RevPAR. Over

the last ten years, the market has achieved an average

occupancy of approximately 74%, which is the highest

in the region;

-

The market achieved a ten-year record performance

in 2004, with occupancy of approximately 86% and an

average rate of US$145, resulting in RevPAR of US$124.

Given the strong RevPAR performance of the market

and its revenue mix characteristics (strong demand

for food and beverage facilities), GOPPAR was US$110,

an almost 90% conversion of RevPAR;

-

In general, the market is likely to experience a slight

decrease (or stable performance) in occupancy in 2005

when compared to 2004; however, strong ADR growth

is anticipated this year (driven by firm pricing strategies

adopted by hoteliers in the market). The steady market

wide occupancy forecast for 2005 is mainly due to

the new supply that entered the market throughout

the year (Park Hyatt, Mina Al Salam, Al Qasr, etc).

However, we would stress that the total number of

room nights in the market will experience a growth

when compared to 2004 levels.

Table 5: Dubai's Historical Market Performances vs Middle

East Market Performance (US$)

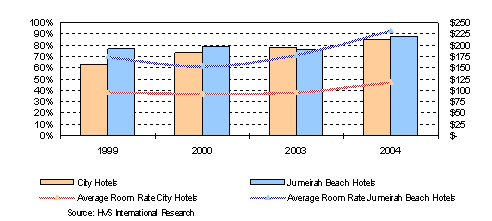

Table 6 illustrates the historical occupancy and average

room rate performance of the Jumeirah Beach and City

hotels.

-

The Jumeirah Beach hotels have outperformed the City

hotels in terms of occupancy over the last five years,

on average by a couple of percentage points;

-

Over the last five years the average room rate achieved

by the Jumeirah Beach hotels was significantly higher

than that achieved by the City hotels; this was driven

mainly by the location of such properties - on the

beach - and by their market/product positioning.

Table 6: Historical Occupancy Performance and Average

Room Rate -City Hotels vs Jumeirah Beach Hotels 1999-04

Other Asset Classes

We

make the following comments on the market characteristics

of other hotel derivatives (or relevant real estate

markets) in Dubai.

-

Given the economic boom in the emirate, and the increasing

number of expatriates visiting (or dwelling in) the

city, demand for serviced apartments has been extremely

strong. This was reflected in the strong operating

performance of this sector of the market over the

last three to five years (occupancy of approximately

87% and an average room rate of approximately US$95);

-

The residential and commercial property markets continue

to experience strong demand, and this has had a further

positive impact on the demand for hotel derivatives.

Such derivatives include serviced apartments, time

share resorts, fractional ownership properties, and

condo hotels. We would stress that while there is

a trivial relationship amongst the general real estate

markets and the various hotel derivatives in mature

markets, in emerging markets such as Dubai, we consider

the real estate market, together with the characteristics

of transient demand, are important barometers that

might signal, or otherwise, the potential demand (and

development opportunities) for various hotel derivatives.

Assessment of Future Trends

Assessment of the Threat of the New Supply, and

Historical Dynamics

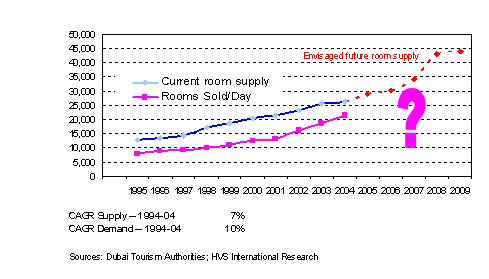

From

our research, we expect between 18,000 and 20,000 hotel

rooms to enter the market by 2010, an increase of almost

100% on the current rooms supply. This will undoubtedly

fuel the risk of an oversupply emerging marketwide in

Dubai!

Table 7: Dubai's Forecast New Supply 2005-09

Over the last decade, hotel supply and demand in Dubai

has grown at a compound average rate of approximately

7% and 10%, respectively, which clearly reflects the

ability of the market to absorb any new level of supply,

as shown in Table 7. This could imply that demand growth

is likely to catch up with supply growth over the next

few years. In addition, we note that Dubai has a stronger

economic base than most other hotel market destinations

in the Middle East, and the emirate benefits from having

possibly the best tourism infrastructure in the region.

This might, in turn, reduce the negative impact of the

new supply.

In

keeping with other emerging markets, the public sector

drives a large proportion of the growth in the tourism

industry. We have conducted a comparative assessment

of tourism-related public spending that compares the

UAE to selected destinations in the region. We would

highlight that, while such benchmarks reflect the country

(or countries) as a whole, in the case of the UAE we

consider such investments to predominantly reflect Dubai

as most public initiatives have, so far, been geared

towards the tourism development of this emirate and,

to a lesser extent, Abu Dhabi.

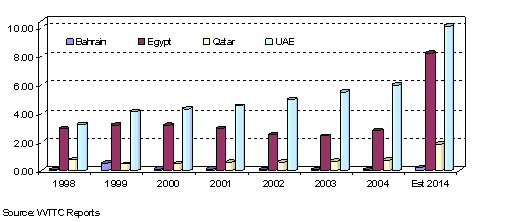

Table

8 illustrates a tourism spending index in regards to

Government Expenditure and Capital Investment in the

UAE as it relates to other destinations in the Middle

East. These benchmarks were obtained from the WTTC country

reports and assessed by HVS International. We note the

following definitions of such benchmarks.

Government Expenditure (Collective) ('GS'): also

known as Non-Market Services (Collective), this category

includes operating expenditure made by government

agencies on services associated with Travel &

Tourism, but not directly linked to any individual

visitor; instead, these expenditure are generally

made on behalf of the 'community at large', such as

tourism promotion, aviation administration, security

services, resort area sanitation services, and so

forth.

Capital Investment ('GI'): also known as Capital Formation,

this category includes capital expenditure by direct

Travel & Tourism industry service providers and

government agencies to provide facilities, equipment

and infrastructure to visitors.

Table 8: Total Government Spending - GS and GI (US$)

Based on an illustrative sample of four countries in

the Middle East (Bahrain, Egypt, Qatar and the UAE),

Table 8 clearly shows that the UAE (notably Dubai) is

the regional leader in terms of public expenditure on

the tourism sector. This reflects both the government's

commitment to growing the industry, as well as a 'supply-led'

hotel market.

By

2014, according to the WTTC, it is expected that Dubai

will double its current 'tourism-related' public expenditure.

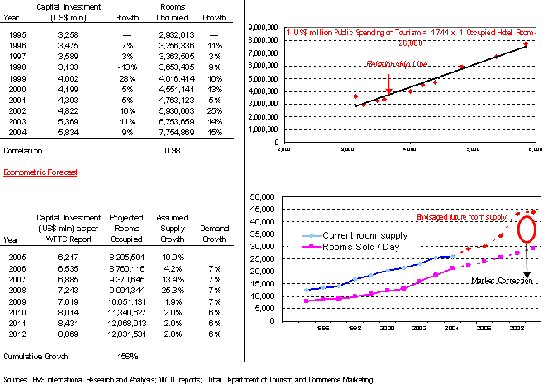

We

(and many professionals in the industry) have historically

considered the hotel market in Dubai to be a 'supply-led

demand' market. This signifies that the demand for hotel

accommodation has historically been driven mostly by

the new supply and government spending associated with

it (be it on marketing, hotel/tourism investments, or

infrastructure such as the airport and airlines). Therefore,

we have conducted a relationship analysis between the

total number of rooms occupied in Dubai and the total

amount of public capital investment in the industry.

Table

9 illustrates our assessment and findings.

Table

9: Relationship Analysis - Public Spending vs Hotel

Demand

We make the following comments on Table 9.

-

The capital investment figures were provided in the

Tourism Satellite Accounting report for the UAE presented

by the World Travel and Tourism Council. The capital

investment figures are those for the UAE in general

and not Dubai in particular. We consider that Dubai,

mainly, and Abu Dhabi, to an extent, are the emirates

principally attracting public capital investment;

-

Our relationship analysis shows that the total number

of room nights in Dubai is almost perfectly correlated

to the public capital investment (on tourism) in the

UAE, at 0.98. In theory, this means that 98% of the

total number of rooms occupied (hotel demand) is explained

by the amount of capital investment in the UAE. We

note that between 1995 and 2004, only once, in 1998,

did capital investment decrease;

-

In light of the high correlation witnessed, we performed

a regression analysis between the two sets of variables.

We obtained an R² value of 0.95 (the R²

value is an indicator of how well the model fits the

data; an R² value of close to 1.0 indicates that

we have accounted for almost all of the variability

with the variables specified in the model);

-

Based on the amount of capital investment in the UAE

projected by the WTTC Tourism Satellite Account and

our relationship analysis, we forecast room nights

for the period 2005-12. Our forecast suggests that

for every 1 million AED in capital investment in the

UAE, annual room nights are likely to increase by

475. On the other hand our analysis shows that were

no capital investment to be made, then the market

would lose 26,000 room nights per annum, which clearly

demonstrates the significance of the public capital

investment (infrastructure, accommodation, and so

forth) as a determinant of future demand;

-

Using our forecast/relationship equation, and based

on the estimated amount of capital spending as per

the WTTC, our forecast suggest that room nights should

increase by 50% due to the public spending anticipated.

We stress that this analysis is a mathematical (econometric/statistical)

forecast, and is for indicative purposes only.

-

Table 9 shows that in 2008, once the new supply comes

on stream, the market performance is likely to be

adjusted when compared to its extraordinary current

performance (occupancy levels of over 90%), to reach

more reasonable performance levels. We note that such

dynamics are considered to be natural occurrences

in emerging markets such as Dubai.

Synthesis and Conclusion

General Market Performance

-

Given the historical growth in hotel demand, the forecast

public spending on tourism in the emirate, and the

current and future projects that are currently being

developed in Dubai we expect demand to experience

an average annual growth of 7%-10% over the next five

to ten years;

-

We expect the hotel market to return a strong operating

performance in 2005 and 2006. The market correction

is envisaged to take place between 2007 and 2009,

once further new supply comes on stream. From 2010

onwards, we expect the market to recover, and occupancy

to stabilise at around 70-75%, when compared to the

current occupancy levels of approximately 90%;

-

We expect the additional supply that will enter the

market to put pressure on average room rate. In 2008

and 2009, we envisage that the market will experience

a slight decline in average room rate, of approximately

5-10% (for five-star hotels);

-

Our projections and conclusions assume that the government

will continue to promote and invest significantly

in the tourism industry in Dubai.

Opportunities and Appeal

- We

consider that, given the current and future supply

and demand dynamics of the five-star hotel sector,

limited further opportunities exist for the development

of such hotels in Dubai. However, opportunities remain

for the development of such properties in other key

locations in the country;

-

We consider that significant opportunities currently

exist in the emirate (and country) for the development

of branded limited service (or three-star) hotels;

-

Opportunities remain for developing extended stay

properties in the market;

-

Given the increased level of leisure demand in Dubai,

opportunities exist for the development of timeshare

properties in the market;

-

In our opinion, the emerging nature of the residential

property market in Dubai, combined with the increased

level of demand for hotel assets (together with the

increased liquidity in the market), provide opportunities

for the development of condominium hotels and other

types of shared ownership properties in Dubai;

-

We expect that international capital (notably from

Asia and Europe) will soon start to be invested in

the hotel industry in Dubai. This will be instigated

by debt capital, followed by equity capital;

-

We expect the hotel lending transaction market in

Dubai to be very active over the next 12 months (mainly

refinancing deals). We forecast the new lending transactions

to have more aggressive terms when compared to the

conservative terms of a typical hotel senior loan

in the market (and region);

-

Short-term cash flow management will be a key area

of focus for asset managers over the next five years.

In the imminent future, long term financial structuring

will remain as the main focus;

*

* *

About the Authors and the Team

Sarah

Leemann

is an Associate with HVS International's London office.

She joined HVS in the summer of 2004, having worked

for two years as a financial analyst for UBS in Switzerland.

She holds a Bachelor of Science in Hospitality Management

from Ecôle Hotelière de Lausanne in Switzerland.

Since joining HVS International, Sarah has conducted

numerous valuations, feasibility studies, and market

studies in Europe, Middle East and Africa. Sarah

Leemann

is an Associate with HVS International's London office.

She joined HVS in the summer of 2004, having worked

for two years as a financial analyst for UBS in Switzerland.

She holds a Bachelor of Science in Hospitality Management

from Ecôle Hotelière de Lausanne in Switzerland.

Since joining HVS International, Sarah has conducted

numerous valuations, feasibility studies, and market

studies in Europe, Middle East and Africa.

Elie Younes is an

Associate Director with HVS International's London office,

and is jointly responsible for the Middle East and Africa

region. He joined HVS  International

in 2001 having had four years' operational and managerial

experience in the hospitality industry in the Middle

East. Elie benefits from his diverse multicultural background

and speaks Arabic, English and French. He holds a BA

in Hospitality Management from Notre Dame University

in Lebanon, an MBA from IMHI (Essec Business School,

France and Cornell University, USA) and is currently

preparing his MSc in Real Estate Investment at Cass

Business School in London. Since joining HVS International,

Elie has advised on and valued various hotel (single

assets, portfolios, and company valuations) resorts,

and extended stay projects in Europe, the Middle East

and Africa. He has also given strategic advice on mid-

and large-scale developments and investment ventures

in the Middle East and Africa. International

in 2001 having had four years' operational and managerial

experience in the hospitality industry in the Middle

East. Elie benefits from his diverse multicultural background

and speaks Arabic, English and French. He holds a BA

in Hospitality Management from Notre Dame University

in Lebanon, an MBA from IMHI (Essec Business School,

France and Cornell University, USA) and is currently

preparing his MSc in Real Estate Investment at Cass

Business School in London. Since joining HVS International,

Elie has advised on and valued various hotel (single

assets, portfolios, and company valuations) resorts,

and extended stay projects in Europe, the Middle East

and Africa. He has also given strategic advice on mid-

and large-scale developments and investment ventures

in the Middle East and Africa.

Bernard

Forster

is a Director with HVS International's London office,

heading the Middle East and Africa region together with

Elie Younes. He joined the company in 1997 from Accor

Hotels & Resorts where he was working in the IT

division, focussing on property management systems,

yield management systems and guest history systems for

Accor Hotels in Europe, the Middle East and Africa.

Previously Bernard worked in various operational management

roles for the Savoy Group in London (now Maybourne Group)

as well as in F&B for the Dolder Grand Hotel in

Zürich. Bernard holds an MSc in Property Investment

from the City University, London, a BSc (Hons) in Hotel

Management from Oxford Brookes University and a diploma

in Hotel Administration from Institut Hotelier 'Cesar

Ritz', Le Bouveret, Switzerland. Bernard

Forster

is a Director with HVS International's London office,

heading the Middle East and Africa region together with

Elie Younes. He joined the company in 1997 from Accor

Hotels & Resorts where he was working in the IT

division, focussing on property management systems,

yield management systems and guest history systems for

Accor Hotels in Europe, the Middle East and Africa.

Previously Bernard worked in various operational management

roles for the Savoy Group in London (now Maybourne Group)

as well as in F&B for the Dolder Grand Hotel in

Zürich. Bernard holds an MSc in Property Investment

from the City University, London, a BSc (Hons) in Hotel

Management from Oxford Brookes University and a diploma

in Hotel Administration from Institut Hotelier 'Cesar

Ritz', Le Bouveret, Switzerland.

About Our Team

HVS International has a team of Middle East experts

operating in the Middle East and Africa (MEA) region,

led by Elie Younes and Bernard Forster. The team benefits

from international and local cultural backgrounds, diverse

academic and hotel-related experience, in-depth expertise

in the hotel markets in the MEA region and a broad exposure

to international and established hotel markets in Europe.

Over the last 24 months, the team has advised on more

than 60 hotels or ventures in the region for hotel owners,

lenders, private equity funds, investment banks, investors

and operators. Together, this team has advised on more

than US$10 billion of hotel real estate. Our services

and expertise for the MEA region include:

-

Market and financial feasibility studies for all types

of hotel derivatives;

-

Investment counselling for mid-and-large scale 'hotel'

funds;

-

Single asset, portfolio, or business/company valuations;

-

Operator search and management contract negotiations;

-

Asset management and operational audits;

-

Assistance on financial structuring and sourcing finance.

For further information about the Middle East markets,

please contact Elie Younes or Bernard Forster.

eyounes@hvsinternational.com

+44 (0)20 7878 7728

bforster@hvsinternational.com

+44 (0)20 7878 7719

Elie Younes, MBA

Director

HVS International - London

7-10 Chandos Street

Cavendish Square

London W1G 9DQ

United Kingdom

Tel: +44 20 7878-7700

Dir: +44 20 7878-7728

Mob: +44 7985 136 205

Fax: +44 20 7878 7799

Email: eyounes@hvsinternational.com

Profile: http://www.hvsinternational.com/Personnel/Elie.Younes.aspx

© HVS International 2005

|

|