|

By

Elie Younes and Bernard Forster

The

following excerpt was taken from a report titled "Middle

East Hotel Markets; Outlooks, Trends and Opportunities,

and Hotel Valuation Index." Published in spring

2006, it was prepared by the London office of Hotel

Valuation Services International (HVS International).

According

to the EIU, real GDP growth in the UAE is forecast to

be around 6% over the next two years. The booming economy

is driving higher inflation

(projected to be approximately 5% in 2005).

The

government is pressing ahead with its reform programmes,

and multibillion-dollar infrastructure, real estate

and tourism projects are taking place in the country

with Dubai and, now, Abu Dhabi being at the forefront.

The

number of visitor arrivals in the UAE increased by approximately

8% in 2005, with Dubai and Abu Dhabi absorbing most

of the growth (in actual terms).

Dubai

is now one of the leading destinations worldwide in

terms of transient leisure and business demand, and

it appears that Abu Dhabi is being carried along by

this momentum.

Quality

hotels in Dubai achieved staggering RevPAR growth of

almost 40% in 2005: RevPAR climbed from US$124 in 2004

to US$171 in 2005.

In

spite of the aggressive pricing attitude of the hotels

and the new supply that became fully operational during

the year (Park Hyatt, Le Meridien Grosvenor House, Radisson

SAS, Villa Rotana Suites, Al Mourooj Rotana) occupancy

was 85%, compared to 86% in 2004.

Moreover,

average room rate grew by approximately 40% on 2004,

to US$202. GOPPAR was estimated to be US$180, an improvement

on 2004 of a phenomenal 60%.

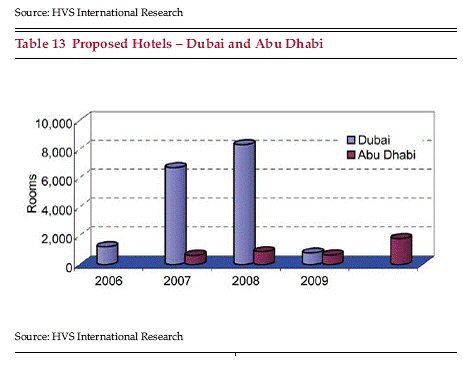

As

shown in Table 13, 17,000 rooms are likely to enter

the market in Dubai over the next four years, and this

will undoubtedly have an impact on the trading performance

of the market, resulting in a likely correction (return

to 'normality') between 2008 and 2009.

We

would highlight that as a considerable proportion of

the new supply is located on The Palm, Jumeirah, some

hotels may not enter the market in 2007 and 2008 as

currently planned. This depends on the severity of the

correction and on the likely completion date of Palm

Island. RevPAR in Abu Dhabi was US$110 in 2005, an increase

of 47% on 2004.

Growth

was driven primarily by an uplift of 40% in average

rate and an increase in occupancy of one percentage

point (which came despite the opening of the new Kempinski

Palace Hotel in 2005).

GOPPAR

was US$93, an impressive 87% higher than it was in 2004.

Due to the limited amount of new supply entering the

Abu Dhabi market between 2006 and 2008, we expect the

market to benefit from continued growth in trading performance

over the next few years; this will undoubtedly further

stimulate investor appetite.

Table

13 illustrates the new hotel supply that is likely to

enter Dubai and Abu Dhabi over the next five years.

As of January 2006 hotel investment values in Dubai

were US$450,000, the highest in our Middle East HVI,

reflecting a regional penetration of approximately 200%.

We

would highlight that our HVI excludes the underperforming

assets in the market (such as the four-star hotel properties

in Deira). According to our assessment, hotel values

in Abu Dhabi were around US$290,000, and values are

likely to experience further growth by the end of 2006.

Elie

Younes and Bernard Forster are Directors of HVS International's

office heading the Middle East and Africa region. For

more information about the Middle East markets, please

contact Mr. Younes at eyounes@hvsinternational.com,

+44 (0)20 7878 7728, and Mr. Forster at bforster@hvsinternational.com,

+44 (0)20 7878 7719.

©

HVS International 2006

|